• In January of this year, Sebi was investigating charges of stock manipulation, fraudulent transactions, and other financial wrongdoing against the Adani Group, according to US-based Hindenburg Research.

• On August 25, Sebi issued an update on the probe, indicating that the extensive investigation, which comprises 24 distinct inquiries into various elements of the Adani conglomerate’s business, is proceeding.

OVERVIEW:

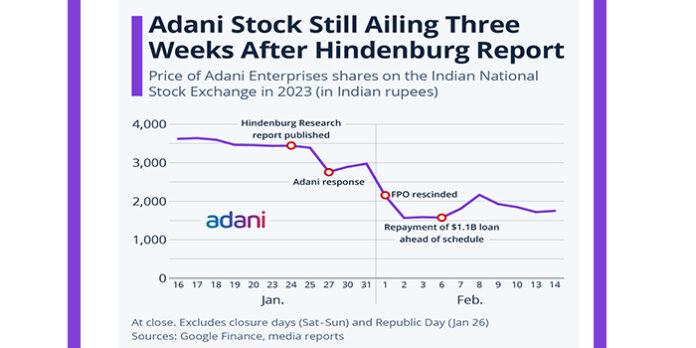

The Adani Group released a thorough response to the Hindenburg report on January 29, disputing the claims and saying that the majority of the observations concern concerns that the company had previously revealed in a timely manner.

In his speech to shareholders, Gautam Adani addressed the conclusions recently made public by the Supreme Court-appointed expert committee. Adani emphasized the findings and claimed that the expert group identified no regulatory problems on the side of the Adani committee. On the BSE, Adani Enterprises Ltd. shares were up 1.53 percent, trading at Rs. 2,509.70. The stock surged 2.55 percent to a high of Rs 2,535 on Tuesday. On Monday, it finished at Rs 2,471.85.

Adani Ports & SEZ was up 1.42 percent, trading at Rs 818.70. Adani Power Ltd was trading at Rs 331.35, up 2.97 percent. Adani Energy Solutions Ltd was trading at Rs 863.60, down 0.16 percent.

The Supreme Court has delayed the hearing in the Adani-Hindenburg Case:

In response to the Securities and Exchange Board of India’s (Sebi) capital market status report, the Supreme Court consented to postpone the hearing in the Adani-Hindenburg case. The Chief Justice of India will continue the preside over the Constitution Bench, which will hear Article 370 applications.

Sebi issued an update on the inquiry into the claims levelled against the port-to-energy corporation

By short-seller Hindenburg Research in its January report on August 25. The release of the final investigation results concluded 22 of the 24 investigations. As a consequence of the continuing inquiry into the Adani Group’s operations, one interim investigation report has also been produced.

Domestic investors and Sebi-registered FPIs and FIIs are permitted to trade in derivatives, which are tools that allow investors to hedge market risks by taking short positions.

Sebi, too, permits regulated short selling and considers that prohibitions may impair effective price discovery, provide promoters with an unrestricted ability to manipulate prices, and therefore favour manipulators.

FPIs are a subset of non-promoters and public shareholders in publicly traded corporations. According to Sebi, listed businesses must maintain a minimum public ownership of 25%.

SEBI further stated that the competent body has authorized an interim report on trading in Adani Group equities prior to and after the release of the Hindenburg report.